Initial Discussions, Financial Planning Meeting & Proposals

No charge

Our initial discussions, followed by a more in depth financial planning meeting, will help you understand the value we can add and exactly what work needs to be done to create your financial plan. There is no charge for either of these meetings as we think it’s important that you have a full and detailed proposal before you decide whether to go ahead with our service.

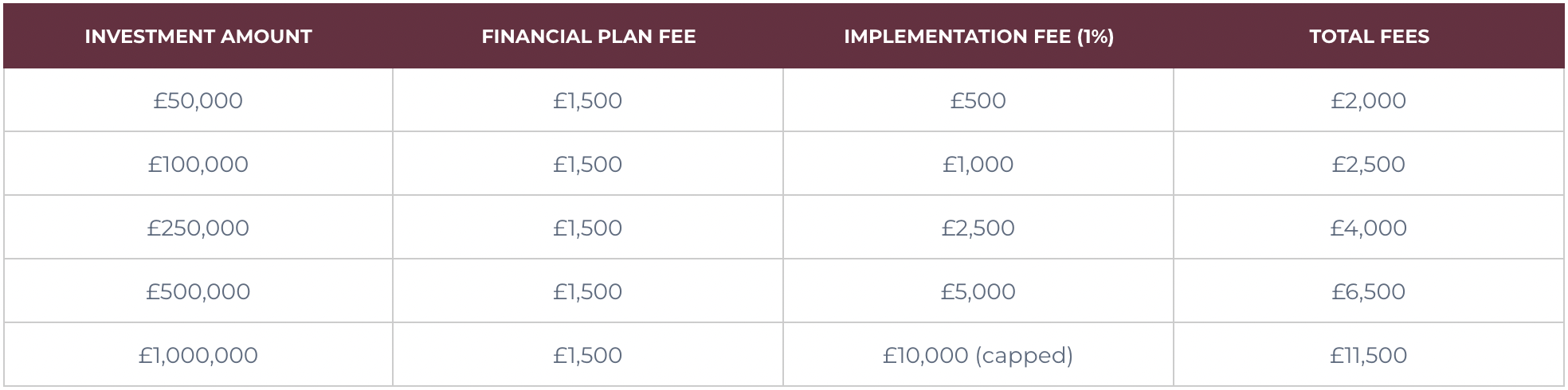

After this point, we charge fees in three ways; a fixed fee to finalise your financial plan and produce your recommendation report, an implementation fee for investing money and an annual fee for ongoing advice and service. The fees you pay will be determined by the services you ask us to provide. We stage them so that you have the flexibility and choice to continue only if, and when, you wish to do so.