We help you assess all your current and future sources of income, including salary, investments, rental income, and any other inflows.

We help you to understand your current and future spending requirements, based upon the lifestyle you want.

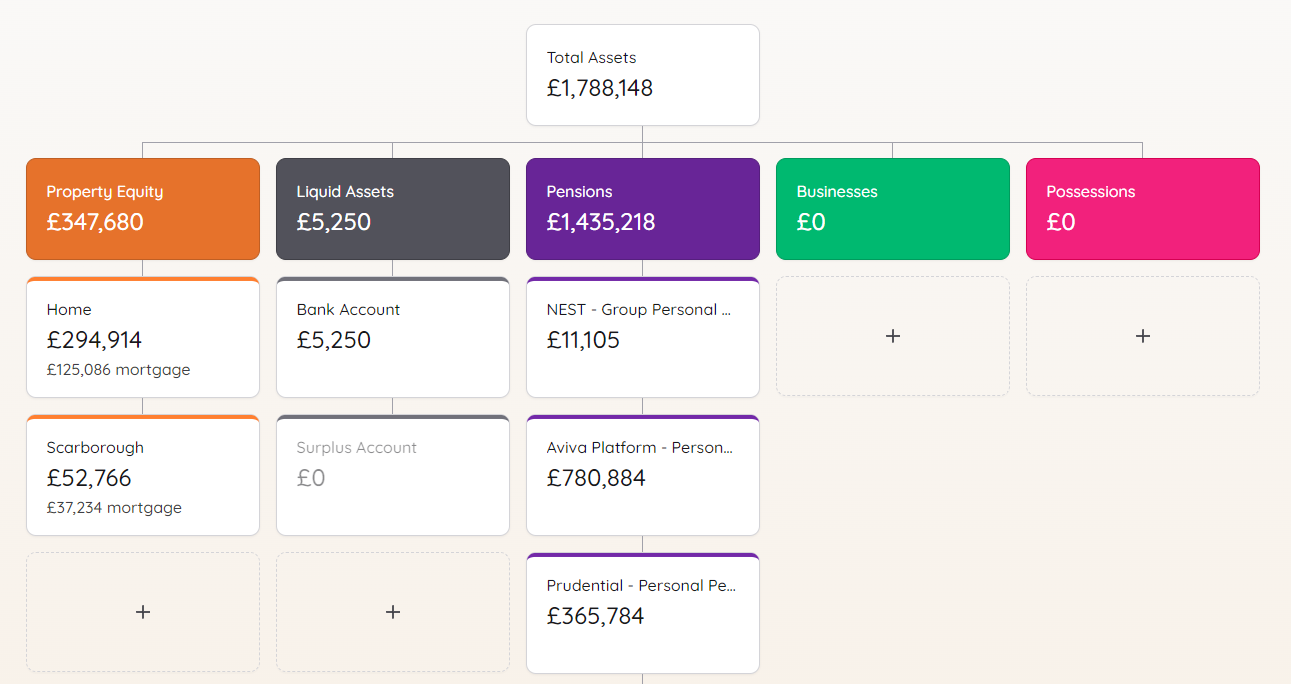

We guide you in setting aside a portion of your income for emergency funds, retirement savings, and other financial goals. By integrating savings and investments into your cash flow model, you can visualize the impact of these actions on your overall financial health.

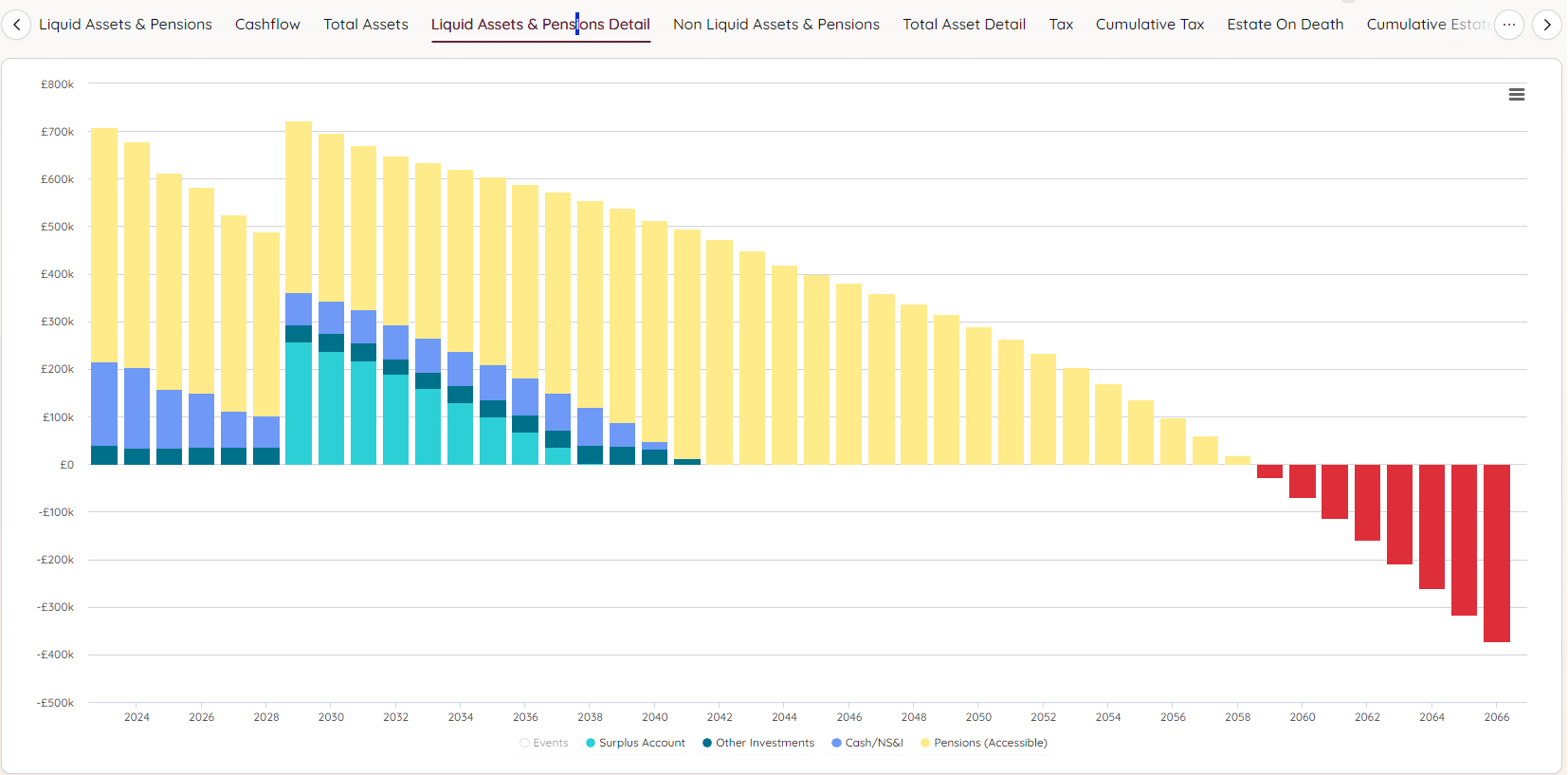

We’ll analyse your cash flow by comparing your total income with your total expenses on a monthly or annual basis. This analysis helps identify any gaps or surplus in your cash flow, allowing you to adjust your spending or savings accordingly.

Personal cash flow modelling enables you to set realistic financial goals, such as paying off debt, saving for a down payment, or planning for a holiday. By visualising the impact of your financial decisions on your cash flow model, you can make informed choices that align with your objectives.

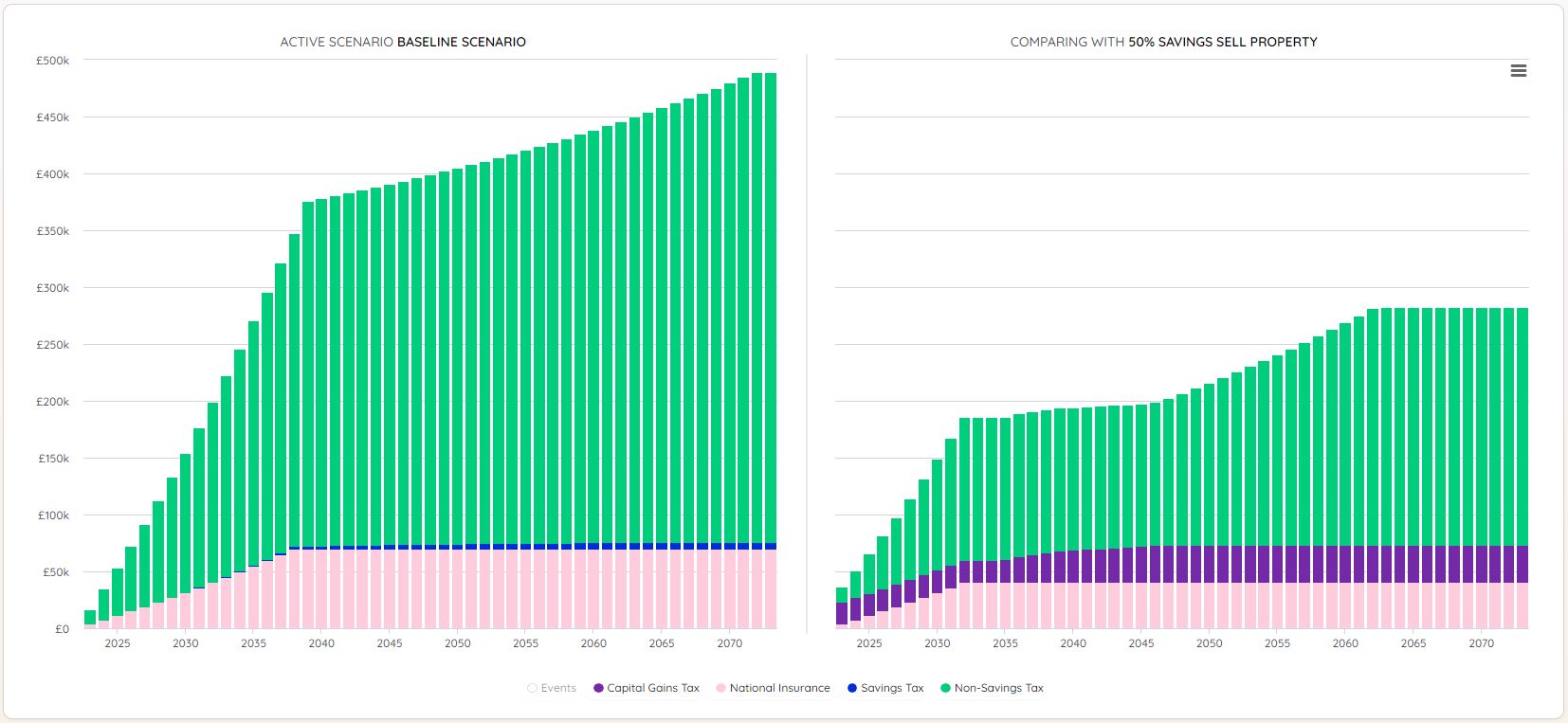

Once we have completed our detailed analysis as your financial sounding board, we can run several ‘what if’ and comparison scenarios. These can really bring to life how your financial future might look and can help you to make important financial decisions based upon reasoned financial assumptions. Things like