Economies and businesses still face challenges, but statistics indicate some of the pressure, including rising inflation, is starting to ease. Read on to find out what affected investment markets in May 2023.

Remember, you should have a long-term outlook when investing. You should have an investment portfolio that reflects your goals and you feel confident in. Please contact us if you have any questions about your investments and what the current circumstances mean for you.

UK

Official figures show the UK narrowly avoided a recession after the economy grew slightly in the last two quarters to March 2023.

While the government said the figures were positive, the UK is still bottom in the G7 for growth since the pandemic. In fact, the UK economy was still 0.5% smaller in the first quarter of 2023 than it was in the final quarter of 2019.

However, both the Bank of England (BoE) and the International Monetary Fund (IMF) have upgraded the UK’s growth forecasts, which could be positive news for investors.

The BoE no longer expects a contraction, but rather for the economy to be stagnant this year.

The IMF also revised its previous prediction. The organisation’s managing director Kristalina Georgieva said authorities have taken “decisive and responsible” steps. The IMF now predicts the UK economy will grow by 0.3% this year, rather than contracting by 0.4% as previously forecast.

Inflation is still stubbornly high but in the 12 months to April 2023, it fell from 10.1% to 8.7%. Yet, the BoE has said inflation will fall slower than previously anticipated. The central bank doesn’t expect to hit its 2% inflation target until early 2025, reports suggest.

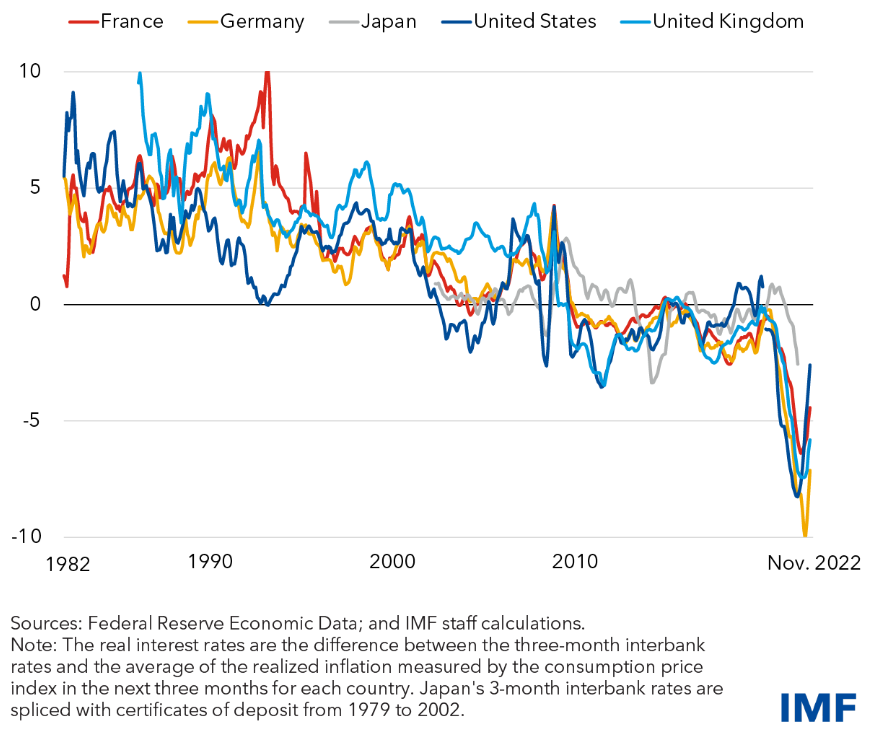

In response to high inflation, the BoE increased its base interest rate to 4.5% – the highest it’s been since October 2008.

Amid high inflation, energy firms are being accused of profiteering. BP reported bumper profits of $5 billion (£4.05 billion) and outstripped forecasts in the first three months of the year. Shell also posted first-quarter profits of $9.6 billion (£7.7 billion). The profits have led to fresh calls for a tougher windfall tax on energy giants.

According to S&P Global’s Purchasing Managers’ Index (PMI), business outlook is improving but some areas are still in contraction. The UK’s service sector posted its strongest growth in a year. However, the manufacturing industry is still in decline, although the pace of contraction is falling.

Reforms to the London Stock Exchange could mean greater risks for investors in British companies, the Financial Conduct Authority (FCA) has warned.

The regulator has plans to abolish stricter “premium” class London stock market listings. This would make it easier for company founders to retain control of their business in a bid to stop the decline of the London stock market, which has struggled to attract new companies over the last decade.

However, the FCA acknowledged that helping the UK economy would lead to higher risks for investors due to fewer checks on listed companies.

Europe

Inflation increased in the eurozone in April to 7%, figures from Eurostat revealed. The rise paved the way for the European Central Bank to make its seventh consecutive interest rate hike – it increased the base rate by 25 basis points.

Despite the rising cost of living, the European Commission (EC) said the eurozone economy “continues to show resilience in a challenging global context”, as fears of a recession start to ease.

The EC now expects member countries to grow, on average, by 1% in 2023, and by 1.7% in 2024.

Similar to the UK, PMI data indicates factories are struggling. Across the eurozone, factory output declined for the 10th consecutive month. However, the readings also suggest that the rising cost of raw materials, driven up by inflation, is starting to ease which could be good news for businesses.

Germany, the bloc’s largest economy, in particular, is facing challenges. Industrial orders fell by 10.7% month-on-month in March. The figures were significantly more than the 2.2% fall expected and the biggest slump since April 2020 when the pandemic led to businesses halting operations.

US

Headline figures paint an optimistic picture of the US.

Inflation fell slightly in April to 4.9% and the US unemployment rate fell to 3.4%, suggesting businesses are feeling confident enough to make new hires.

However, a survey from the National Federation of Independent Businesses suggests small businesses are worried about the economic outlook and worker shortages.

There are also growing concerns about banks failing in the US. The crisis started with Silicon Valley Bank collapsing in March. At the start of May, trading in the shares of two regional banks was temporarily suspended after dramatic drops.

Central banks maintain the current situation is not similar to the 2008 financial crisis, and, with the exception of Swiss bank Credit Suisse, the crisis hasn’t affected European banks.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.