Data from economies around the world indicate business output and confidence could be slowing. Read on to find out what influenced the investment market in July 2023.

Despite some data suggesting there could be a downturn in some areas, the International Monetary Fund (IMF) has lifted its global growth forecast for 2023. The organisation now expects the global economy to grow by 3%, up from its previous prediction of 2.8%.

Globally, both households and businesses could face pressure as energy prices may rise in the colder months. The International Energy Agency warned that, if China’s economy rebounds this year, energy prices may spike in winter.

UK

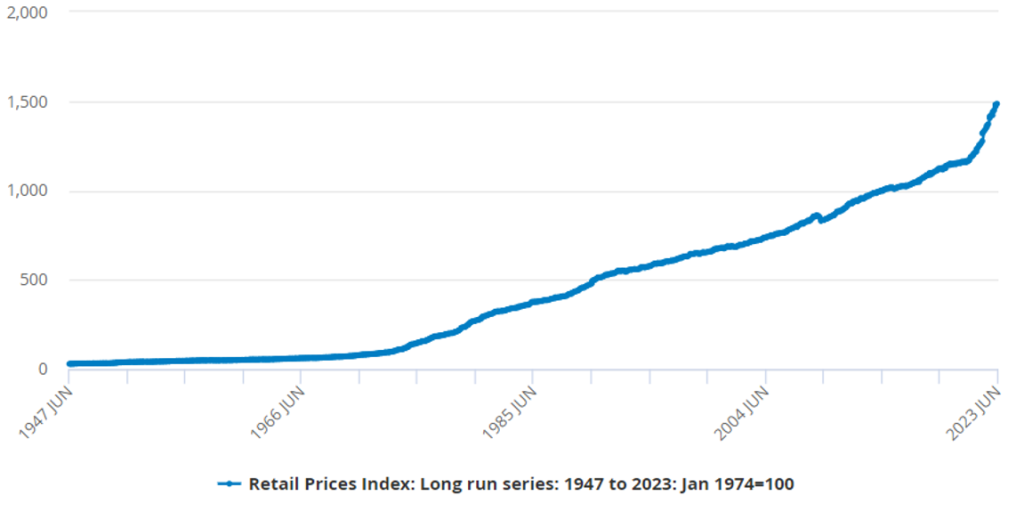

The pace of inflation in the UK is slowing. Yet, it remains stubbornly high and above many other economies at 7.9% in the 12 months to June 2023. The latest inflation figures prompted the Bank of England (BoE) to hike its base interest rate again – as of July 2023, it stands at 5%.

The IMF predicts the BoE will need to keep interest rates high for longer than expected due to economic challenges.

Further rises could cause market volatility – the FTSE 100 hit its lowest closing level of 2023 ahead of the July BoE announcement at the start of the month.

The interest rate increases have led to mortgage rates soaring. In July, the average five-year fixed-rate mortgage deal exceeded 6% for the first time since 2008. In fact, by the end of 2026, the BoE predicts that 1 million households will see their monthly mortgage repayments increase by £500.

While many borrowers have been affected by interest rates increasing almost immediately, saving rates have been lagging. The Financial Conduct Authority set out expectations for “fair and competitive savings” during the month, and savers may have started to see the earnings on their savings rise as a result.

The latest release from the Office for National Statistics shows that between February and April 2023, the average wage increased by 7.2%. While growth is good news, the figure is below inflation and so wages are falling in real terms.

As well as soaring mortgage costs, food inflation has significantly affected household budgets. So, it may be of little surprise that a survey for i newspaper found 67% of consumers would back the idea of a price cap on essential goods.

Data suggests many businesses are struggling too.

According to a Purchasing Managers’ Index (PMI) UK factories shrank at their fastest pace in six months in June. Output, new orders, and employment levels all fell and could signal the challenges will continue into the medium term.

As businesses struggle with rising costs, insolvencies are expected to rise. Figures released by the Insolvency Service show business bankruptcies were 27% higher in June when compared to the same period in 2022.

Begbies Traynor, a business recovery and financial consultancy, believes insolvencies will rise over the next 18 months due to interest rate hikes. The firm added that “zombie” businesses have been able to continue operating due to cheap borrowing costs but will now struggle to service debts.

While there have been ups and downs in the market throughout July, the pound hit a 15-month high after all major UK banks passed BoE stress tests.

Europe

Inflation in the Eurozone fell to 5.5% in the 12 months to June 2023. While still above the long-term average, it’s lower than the 8.6% recorded in June 2022.

In response, the European Central Bank increased interest rates to its highest level in more than 20 years. The deposit rate is 3.75% as of July 2023.

PMI data indicates businesses in the Eurozone are facing similar challenges to the UK. Overall business activity fell and moved into negative territory. Factory output was also weak in June, particularly in Austria, Germany and Italy, and employment fell for the first time since January 2021.

US

Steps taken by the Federal Reserve have successfully slowed inflation in the US. In the 12 months to June, it was 3% – a two-year low.

According to PMI data, the US factory sector took a “sharp turn for the worse” in June. The results mirror the situation in Europe, with new orders falling. It’s increased concerns that the country could slip into a recession in the second half of the year.

While there may be worries about the US economy, official data indicates businesses are still confident about their future. American companies added half a million jobs to the economy in June and US wages increased by 4.4%.

In company news, Twitter’s rebrand to X is estimated to have wiped billions off the company’s value.

Since Tesla owner Elon Musk took over the social media platform in October 2022, he’s made a raft of changes. In July, Musk revealed a new name and logo for the platform, which have drawn criticism. According to Fortune, changing the name has wiped out between $4 billion and $20 billion in brand value.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.