While a new year started, many of the key factors affecting economies and markets in January were the same as those in 2023, namely high levels of inflation and recession fears.

The World Bank warned the global economy is set to slow for a third successive year in 2024 and is on course for the weakest half-decade of growth since the early 1990s. It added there was a risk that the 2020s would be a “wasted” decade following a series of setbacks, including the pandemic.

Tensions in the Red Sea are also affecting businesses and economies around the world. The German Economic Institute said global trade fell by 1.3% in December as a result of attacks on merchant ships. The volume of container transport in the Red Sea fell by more than half at the end of 2023 and could have implications for many businesses relying on goods.

Read on to find out what else affected markets at the start of 2024.

UK

There was positive news when the Office for National Statistics (ONS) released the latest GDP figures at the start of the year. November posted growth of 0.3%, after a contraction in October. However, experts warned the UK was still at risk of a technical recession – defined as two consecutive quarters of negative growth.

Yet, EY Item Club said it expects UK economic growth to rebound in late 2024 as both inflation and interest rates are predicted to fall.

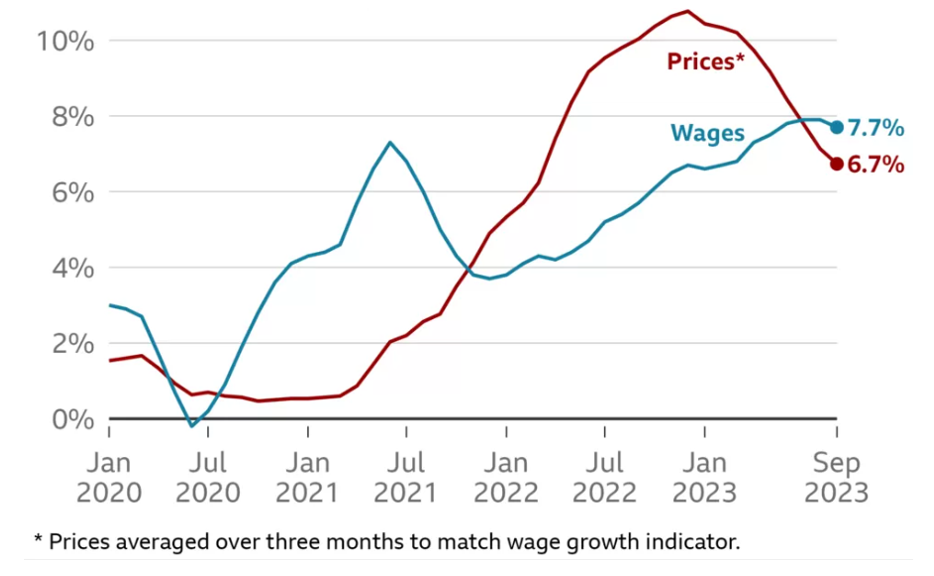

Data indicates that inflation in the UK is stabilising, but it’s still above the Bank of England’s (BoE) 2% target. In the 12 months to December, inflation was 4%, a slight increase on the 3.9% recorded in the previous month.

Higher interest rates to tackle inflation have been placing pressure on both households and businesses, but they’ve also presented an opportunity for investors with government bonds becoming more attractive. The sale of £2.25 billion of 20-year bonds attracted bids for 3.62 times the volume on offer.

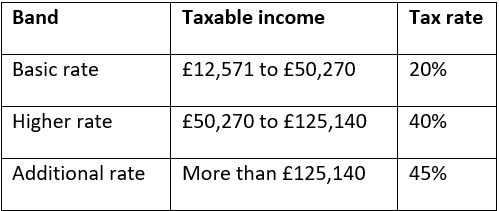

Chancellor Jeremy Hunt is preparing to deliver the Budget on 6 March 2024. According to reports, government borrowing halved year-on-year in December, which has reportedly given Hunt the scope to make around £20 billion worth of tax cuts if he chooses. With a general election looming, it could be an opportunity to ease the tax burden.

Businesses as well as households may look to the budget to ease some of the pressure they’re facing.

Insolvency experts at Begbies Traynor warned that more than 47,000 UK businesses are on the “brink of collapse” as the number of firms in “critical” financial distress increased by 25% in the final three months of 2023 when compared to the previous quarter.

Some other businesses plan to make cuts in the coming months too. One such firm is Tata Steel, which announced plans to cut up to 2,800 jobs by the end of the year. The news was met with strong words from union Unite, which pledged to use “everything in its armoury” to defend steel workers.

Some businesses are posting positive news though. Retailer Next saw a 10% jump in sales in the two weeks before Christmas, which led to its shares hitting an all-time high of more than £85.30 at the start of January.

Europe

As the European Central Bank (ECB) predicted, inflation across the eurozone increased in January. In the 12 months to December 2023, the rate of inflation was 2.9%, official statistics show. The ECB said it expects inflation to remain between 2.5% and 3% throughout 2024.

ECB vice president Luis de Guindos went on to warn that the eurozone may have already fallen into a technical recession and prospects remain weak.

Data from Germany’s national statistics office, Destatis, paints a pessimistic outlook. The country is on track for its first two-year recession since the early 2000s as the economy shrank by 0.3% in 2023. The decline was linked to higher energy costs and weaker industrial demand.

Low demand looks set to plague the eurozone’s largest economy into 2024 too. In December, industrial output was weaker than expected and fell by 0.7% month-on-month.

While many economies have battled double-digit inflation over the last couple of years, in many cases, they’ve now started to fall. One outlier is Turkey, which saw an inflation rate of almost 65% in the year to December 2023.

The huge rise is partly attributed to an almost 50% increase in the nation’s minimum wage. Demand from tourists is also having an effect. For example, hotel prices jumped 93% year-on-year.

US

US inflation also increased in the 12 months to December 2023 to 3.4%, compared to 3.1% recorded a month earlier. The rise was linked to higher housing and energy costs.

Similar to economies in Europe, some sectors in the US are struggling due to weak demand. The Institute for Supply Management found that US factories contracted in December for the 14th consecutive month. Yet, job data indicates that businesses are feeling optimistic, as they added 216,000 new jobs at the end of 2023.

On 22 January, the US stock market reached a record high. The S&P 500 index, which tracks the 500 largest companies listed on stock exchanges in the US, increased by 0.5% as technology stocks rallied.

US company Microsoft also started the year strong when it overtook Apple to become the world’s most valuable company on 11 January. The firm’s share price increased by 1.5% to boost its market valuation to $2,888 trillion (£2,272 trillion).

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.