The US struck trade deals with several countries in July 2025, leading to markets rising and putting an end to some of the uncertainty that had plagued investors for months. Read on to find out what else may have affected your investments recently.

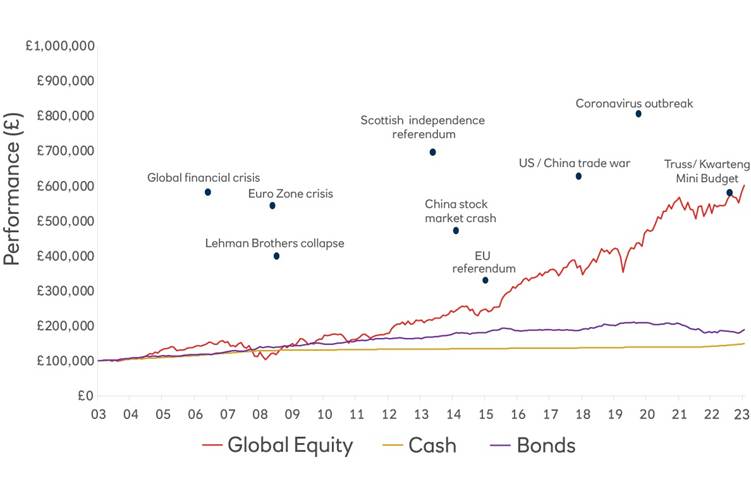

While it might seem like 2025 has been a poor year for investors, due to geopolitical tensions and trade wars, the figures paint a different picture.

In the first half of 2025, the FTSE 100, an index of the 100 largest companies listed on the London Stock Exchange, gained 7.2%. It’s the best performance in the first six months of the year since 2021. The data shows how markets often bounce back following short-term market movements, as the index fell sharply in April due to US tariff announcements.

Remember, while markets typically deliver returns over a long-term time frame, they cannot be guaranteed, and it’s important to invest in a way that reflects your risk profile and goals.

Trade deals lead to market rallies in July 2025

While uncertainty affected markets in July 2025, there were also several record highs.

On 3 July, it was announced that the US and Vietnam had struck a trade deal. In addition, US data showed 147,000 new jobs were created in June. The good news led to global stocks reaching a record high, according to MSCI.

US President Donald Trump previously set a deadline for trade deals. As this date approached on 7 July and countries without a deal faced high tariffs, shares on key US indices dipped slightly. The Dow Jones Industrial Average fell 0.16% and the S&P 500 was 0.3% lower.

With the trade deal deadline looming, Trump announced a pause on the levies for 14 trading partners to give countries time to negotiate with the US. It led to Asia-Pacific indices rising, including Japan’s Nikkei 225 (0.3%), South Korea’s KOSPI (1.9%), and China’s CSI 300 (0.8%).

The good news continued the following day. The FTSE 100 climbed 1.23% to close at a record high. Mining stocks led the way with Glencore, Rio Tinto, and Anglo American all up more than 3.5%.

On 14 July, European markets opened lower after Trump threatened to impose a 30% tariff on EU imports in August. The pan-European Stoxx 600 index was down 0.6%. Falls were also recorded on the main indices for Germany, France, Italy, and Spain.

There was further positive news for investors of stocks on the FTSE 100 index on 15 July. It hit 9,000 points for the first time after a rise of 0.2%. The UK was one of the few countries to have a trade deal with the US, and UK stocks benefited from trade tensions as a result.

The US and Japan reached a trade deal on 23 July. Under the deal, Japanese goods will incur a 15% tariff at the US border compared to the 25% Trump had previously threatened.

On the back of the news, Japan’s Nikkei index jumped 3.75%. Carmakers in particular saw rises, including Toyota (14.5%), Honda (10.8%), Subaru (16.8%), and Mazda (17.75%).

There was yet more trade deal news on 28 July when an agreement between the US and EU was announced. Indices across the EU were up as a result, including Germany’s DAX (0.8%), France’s CAC 40 (1%), and Spain’s IBEX (0.8%).

UK

With the Autumn Budget due in October, Reeves faces increasing pressure as key data released in July 2025 was negative.

Indeed, the Office for Budget Responsibility (OBR) said public finances are in a “relatively vulnerable position” with risks posed by tariffs, defence costs, and an ageing population. Based on current tax and spending policy, the organisation said public debt was on track to hit 270% of GDP by the 2070s. The projection would see public debt almost triple compared to the current level.

The concerns around public debt were further highlighted when UK borrowing increased to £20.7 billion in June 2025 due to interest payments rising. Worryingly, the figure was £3.5 billion more than the OBR’s forecast and could prompt the chancellor to raise taxes or cut spending.

In addition, data from the Office for National Statistics shows the UK economy shrank in May for the second month running. The 0.1% contraction was driven by a slump in industrial output.

The rate of inflation also unexpectedly increased to 3.6% in the 12 months to June 2025. It’s the third consecutive monthly increase and was the highest rate recorded since February 2024.

While the Bank of England’s Monetary Policy Committee didn’t meet to discuss interest rates in July, member Alan Taylor signalled a cut was likely in August. He said the “deteriorating” UK economy warranted a deeper interest rate cut than financial markets currently predict.

A Purchasing Managers’ Index (PMI) measures economic activity, and a reading above 50 indicates growth. In June, S&P Global’s PMI data for the UK found that the:

- Manufacturing sector continued to contract with a reading of 47.7, but hit a five-month high

- Construction sector was also contracting, but reached a six-month high with a reading of 48.8

- Service sector posted its strongest growth in 10 months with a reading of 52.8, and improvements in order books indicate further growth in the months ahead.

So, while there are setbacks for many UK businesses, the figures suggest there’s movement in the right direction.

Europe

The eurozone hit the European Central Bank’s (ECB) 2% inflation target in the 12 months to June 2025.

Over the last 12 months, the ECB has cut its base interest rate by a quarter percentage point eight times, taking the policy rate from 4% to 2%. Despite speculation that there would be a further cut when inflation hit its target, the central bank opted to leave the rate as it was.

S&P Global’s PMI suggests the manufacturing sector across the eurozone continues to contract. However, the data indicates it may have turned a corner as the reading in June 2025 was the highest in 34 months and only just below the 50 mark at 49.5.

As the bloc’s largest economy, Germany’s exports are essential and ongoing challenges could dampen growth this year, though the new US-EU trade deal may ease some of the pressure.

A Destatis report found that German exports fell by 1.4% in May when compared to a month earlier. Exports to the US played a significant role as they were down 7.7% month-on-month and 13.8% lower than the same period in 2024.

Germany’s central bank, the Bundesbank, said the country’s exporters were losing competitiveness and called for urgent reforms to improve the business climate, including reducing barriers for skilled migrants and enhancing tax breaks for private investment.

US

Official data from the Bureau of Statistics shows that inflation increased in the 12 months to June 2025 to 2.7%. The figure is above the Federal Reserve’s 2% target.

Tariffs and uncertainty continued to leave a mark on the US’s trade deficit.

In May, the trade deficit widened by 18.7% when compared to a month earlier, according to official data. The deficit now stands at $71.5 billion (£53.5 billion) as exports dropped by 4%.

The consumer sentiment index from the University of Michigan suggests people are feeling more optimistic. The reading in July was 61.8, up from 60.7 in the previous month. It was the highest score since the trade wars began five months ago.

American chipmaker Nvidia became the first listed company to reach a valuation of $4 trillion (£3 trillion). The company announced it would build high-powered systems to train its AI software, which led to shares soaring. As of the start of July, the company’s shares have gained 22% in 2025.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up, and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.