While global government policy – particularly US trade tariffs – continued to influence the value of investments in August 2025, many markets experienced less volatility compared to the start of the year. Read on to discover what factors may have affected the performance of your investments in August 2025.

Hopes of a peace deal between Russia and Ukraine boost markets

On 31 July, Donald Trump, the US president, signed an executive order imposing reciprocal tariffs of up to 41% on certain trading partners. The effect of this influenced market movements at the start of August.

On 1 August, Asian stock market indices, which track the performance of a selected group of stocks, fell. South Korea’s KOSPI was down 3%, while Japan’s Nikkei decreased by 0.4%.

The uncertainty also affected European and US markets. Even though the UK has a trade deal with the US, the FTSE 100 was down 0.5%, while the Dow Jones (-1.1%) and S&P 500 (-1.2%) both fell when Wall Street opened in the US.

There was good news for investors in the UK market on 6 August. The FTSE 100 reached a new closing high after it increased by 0.24%. Among the biggest risers were insurer Hiscox (9.4%), precious metal producer Fresnillo (8.9%), and drinks company Diageo (4.2%).

Ahead of US-Russia talks about the war in Ukraine, European stocks cautiously increased on 11 August. The FTSE 100 was up 0.3%, Germany’s DAX and France’s CAC both edged up almost 0.2%, and Italy’s FTSE MIB increased by 0.45%.

The MSCI’s broad All Country World Index, which tracks stocks from 23 developed and 24 emerging markets, hit an all-time high on 13 August. One of the driving factors was the hope that the US will cut its base interest rate in September.

Further speculation that Russia and Ukraine would strike a peace deal fuelled European stock markets on 19 August. Europe’s Stoxx 600 index increased by 0.6%.

In the first half of 2025, European defence companies saw stocks increase due to rising tensions. With investors hoping for de-escalation, defence stocks, including BAE Systems (-3.6%), Rheinmetall (-4.2%), and Thales (-3.5%), fell.

Despite official data showing inflation was higher than expected in the UK, the FTSE 100 hit another record high on 20 August following a jump of 0.67%.

UK

Inflation in the UK continued to rise in the 12 months to July 2025. Official data shows it was 3.8% and the highest annual reading since early 2024.

Despite persistent high inflation, the Bank of England opted to cut the base interest rate by a quarter of a percentage point to 4%. However, the central bank noted that inflation could slow the pace of further cuts.

Overall business activity is improving, according to a Purchasing Managers’ Index (PMI), which provides insight into economic conditions.

S&P Global’s August PMI recorded the strongest rise in UK business activity in the year to date, with a reading of 53 (a figure above 50 indicates growth) compared to 51.5 in July.

However, PMI data wasn’t as positive for the construction sector. In July, the reading was 44.3, suggesting contraction at the fastest pace in five years. Builders reported a decline in housing projects, which could suggest the government is struggling to hit housebuilding targets.

A report from the British Chambers of Commerce demonstrates the effects of trade tariffs. Goods exported to the US slumped by 13.5% in the second quarter of 2025. The figure is the lowest level in three years, when the Covid-19 pandemic severely disrupted trade.

There was some good news for investors from British fossil fuel giant BP.

BP revealed the largest oil and gas discovery in 25 years off the coast of Brazil. The news was followed by a statement from the company, which said, subject to board approval, it would raise quarterly dividends by at least 4%.

Europe

Eurozone inflation remained stable at 2%, though it varied significantly across the bloc from Cyprus at 0.1% to Romania at 6.6%.

PMI figures from Hamburg Commercial Bank paint an optimistic picture for the EU economy.

As the largest economies in the EU, the performance of companies in Germany and France is important, and both strengthened in August. Germany’s PMI improved for the third consecutive month with a reading of 50.9. While France is just below the 50 mark, which indicates growth, with a reading of 49.8, it’s the highest figure so far in 2025.

Across the eurozone, PMI data shows the manufacturing sector increased production at the fastest pace in more than three years. The reading suggests businesses may be feeling more optimistic as uncertainty around trade tariffs settles.

US

Economists predicted that US inflation would increase, but it remained stable at 2.7% in the 12 months to July.

Weakening demand for US exports due to tariffs has been linked to manufacturing slowing and the trade deficit narrowing.

A PMI conducted by the Institute of Supply Management shows new orders fell in July. Some companies blamed the disruption and confusion caused by changing trade policy.

In addition, the US trade deficit narrowed as companies rushed to import goods into the US before tariffs were applied. The gap between exports and imports was $60.2 billion (£44.5 billion) in June 2025 after a decline of $11.5 billion (£8.5 billion) when compared to May 2025.

There was some good news in the form of PMI data. According to S&P Global, US business activity hit an eight-month high.

US company OpenAI, the group behind ChatGPT, is in talks about a share sale that would value the company at $500 billion (£370 billion). The company isn’t listed on the stock market, and the talks are focusing on a potential sale for current and former employees, who could potentially make large returns by selling the shares on the secondary market.

Asia

China’s exports increased by 7.2% year-on-year in July 2025. The figure was higher than expected and is due to manufacturers taking advantage of a trade war truce between China and the US.

However, while exports increased in July, the ongoing trade war is harming China’s economy. Chinese industrial output increased by 5.7% in July, the slowest rate since November 2024 and below the 6% expected.

The largest automaker in the world, Japanese company Toyota, warned it would take a $9.5 billion (£7 billion) hit from Trump’s tariffs. As a result, it has cut its operating profits for the current financial year from £19.2 billion to £16 billion.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

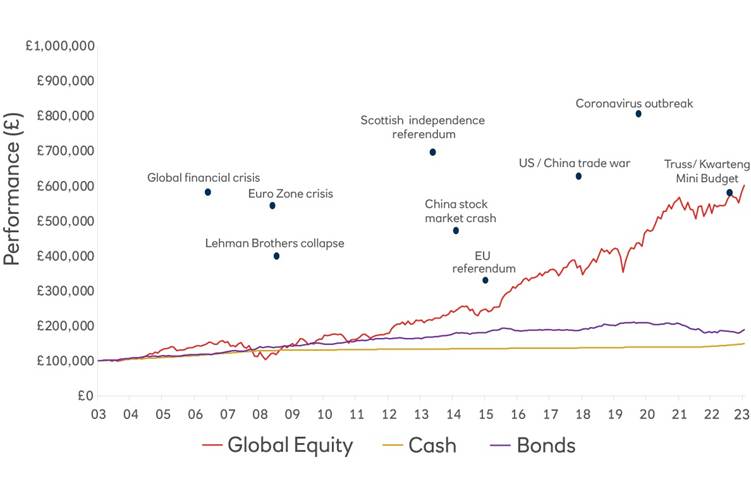

The value of your investments (and any income from them) can go down as well as up, and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.