Over the last few months, you’ve read about the potential benefits of investing, what to consider when creating a risk profile, and how you could improve tax efficiency.

Now, read on to discover why reviewing your investment portfolio is a crucial part of managing your assets over the long term.

Reviewing your investments too frequently could encourage short-term thinking

Reviewing your investments provides an opportunity to ensure your portfolio still suits your needs and understand whether you’re on track to meet your goals. So, how frequently should you be reviewing your portfolio?

With daily headlines about company stocks that have risen or fallen, it can seem like you should be checking your portfolio every day or week. Yet, this could encourage a short-term mindset when managing your investments.

Looking at your investments too frequently can make it tempting to try and time the market. While selling high and buying low is something every investor wants, many factors affect the markets and it’s impossible to consistently time it right. It could mean you miss out on long-term growth opportunities.

Instead, reviewing your portfolio once or twice a year is often enough for many long-term investors. This frequency may help you strike a balance between understanding how your portfolio is performing and focusing on the long term.

4 key questions to answer during the review process

1. Have your long-term investing goals changed?

The reasons you’re investing may affect which options are right for you. As well as looking at figures, taking some time to review your investment goals may be important.

If your goals have changed, it could affect the investment time frame and how much risk is appropriate. As a result, you might adjust your portfolio to ensure it continues to reflect the outcomes you want.

2. Are your financial circumstances the same?

As well as your goals, you may want to consider if your financial circumstances have changed since your last review.

Again, your financial security and other assets you hold often influence your risk profile when investing. So, significant changes to your situation could mean adjustments to your portfolio make sense.

For example, if you’re approaching retirement, you may decide to reduce the amount of risk you’re taking to preserve your wealth. Or, if you’ve received a wealth boost, you might want to increase the size of your portfolio and allocate a proportion of it to higher-risk investments.

3. How has your portfolio performed?

While it’s often a good idea not to review your portfolio’s performance too frequently, the returns are a crucial part of the review process.

If your portfolio hasn’t performed as well as you’d hoped, be cautious of making knee-jerk decisions in response. The key thing is to focus on long-term trends rather than short-term movements.

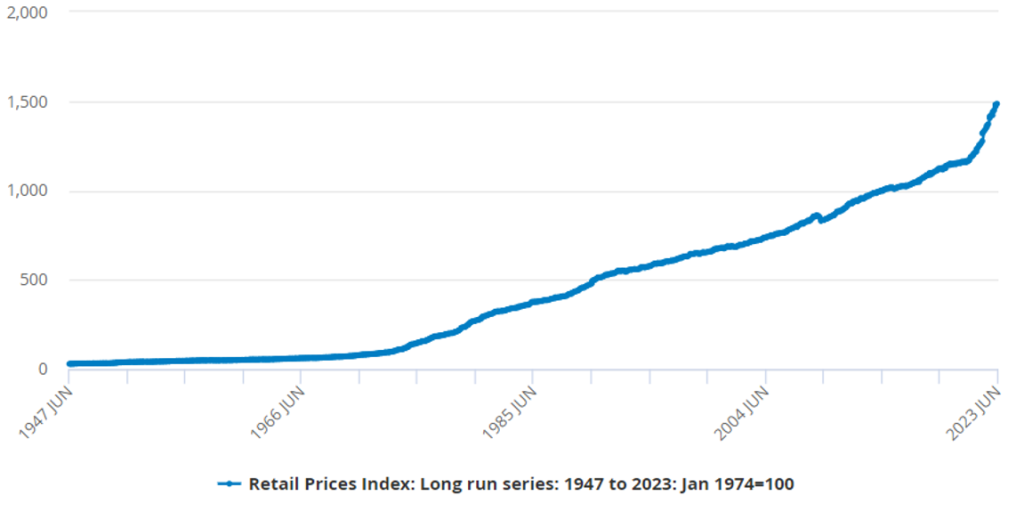

Volatility is part of investing, and it’s normal to see the value of your portfolio rise and fall. Yet, when you look at the performance over the years, the peaks and troughs often smooth out.

Even after market shocks, such as when the markets fell sharply during the Covid-19 pandemic, historically, they have recovered and gone on to deliver returns when you look at the bigger picture.

Rather than reviewing just the last 6 to 12 months of data, consider how your portfolio has performed since you set it up. You may also want to consider long-term projections too, although keep in mind these cannot be guaranteed.

As well as looking at your portfolio’s performance, reviewing the wider market may be useful. If your portfolio has suffered a dip, has the rest of the market fared similarly?

4. What investment fees have you paid?

The fees you pay when investing will reduce your overall returns. As a result, it’s also worth considering what fees you’re paying, how they relate to your portfolio, and how they compare to alternative options.

We can help create and manage your investment portfolio

Whether you’re just starting to invest or want support managing your portfolio on an ongoing basis, we could offer professional advice.

An investment strategy that’s tailored to you could reflect your aspirations, financial circumstances, and tax-efficient opportunities. We can also incorporate your investments into a wider financial plan that’s focused on your goals.

Please contact us if you have any questions about investing or would like to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.