Pension savers dubbed “triple defaulters” could be overlooking small changes to their pension that may make their long-term finances more secure. Have you reviewed these three important pension decisions recently?

According to a survey from Aviva, millions of workers who have been auto-enrolled into a pension scheme have never updated their contributions, investment choices, or target retirement age. The findings could suggest many people are approaching retirement unprepared.

Indeed, more than half of those on a middle income due to retire in the 2050s say they have never heard of or know nothing about their retirement options. So, it’s no surprise that just 1 in 5 said they feel prepared in terms of how they will fund their retirement.

As your pension is typically invested for decades, even a small change could lead to the value of your savings at retirement being thousands of pounds more. So, you could benefit from reviewing these three pension decisions.

1. What percentage of your income is added to your pension?

If you’ve been automatically enrolled into a pension, you’ll pay the minimum contribution level. This is currently 5%, including tax relief, of your pensionable earnings.

While this might sound like a reasonable figure to put aside for your retirement, it could mean your lifestyle once you give up work falls short of your expectations.

According to the Aviva research, a person earning the median salary throughout their career who contributes the minimum amount to their pension from the age of 22, could expect a pension fund of around £225,000 when they retire in the 2050s.

This falls short of the savings a retiree is predicted to need to achieve a “moderate” lifestyle, according to the Pensions and Lifetime Savings Association.

In this scenario, if the individual puts an extra 2% of their income into their pension, its value could be £56,000 more at retirement – an increase of 25%.

Of course, many factors affect the value of your pension at retirement and performance cannot be guaranteed. However, the example demonstrates how regular contributions could add up to a substantial sum over the long term.

2. How is your pension invested?

Usually, when a pension is opened for you, your savings will be invested through a default fund. However, this might not be the best option for you, so it could be worth looking at the alternatives.

Typically, a pension provider will offer several different funds with various risk profiles. Some may also offer funds with “sustainable” objectives, which will invest in companies that meet its environmental, social, and governance (ESG) criteria. You may find that a different fund is more suitable for you once you review them.

Using the same scenario as the above example, a 22-year-old who secures higher investment returns of just 1% throughout their working life could see their pension value increase by £57,000 at retirement.

3. What is your target retirement date?

You don’t have to set a retirement date straight away, but having an idea of when you’d like to retire is also important.

If you haven’t manually set a retirement date with your pension fund, your provider will usually set it at State Pension Age. There are two key reasons why it’s important your retirement date is accurate.

First, your pension provider will send you annual statements, which will include a projection of the value of your pension at retirement. If you decide to retire sooner, you could find your pension savings fall short.

Second, pension funds will often automatically reduce the amount of risk your investments are exposed to as you near your retirement date to limit the effect of short-term volatility. So, setting the retirement date could help you manage risk.

Just 1 in 10 middle-income pension savers retiring in the 2050s have sought professional advice

As well as overlooking important pension decisions, the survey also suggests many aren’t taking professional financial advice.

Just 1 in 10 people who receive a middle income and will retire in the 2050s have already sought professional advice. This compares to around 37% of the same group in the US.

Interestingly, 58% of Brits who have retired in the last 10 years say they wish they’d known more about pension needs when they were younger.

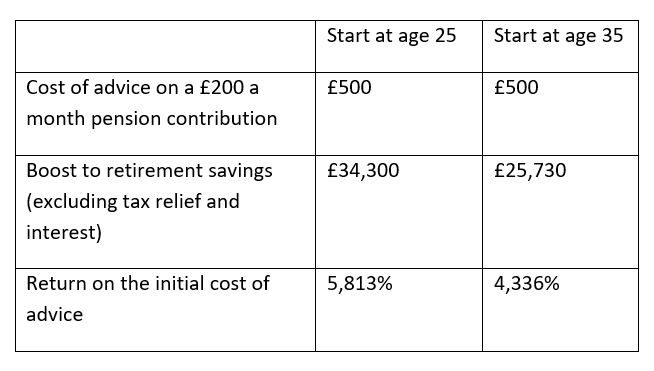

Even if retirement is a goal that’s still several decades away, seeking advice about how to secure your long-term finances could provide you with more freedom later in life. It could also ensure you have the information you need to make informed decisions about your pension now and understand the long-term effects they could have.

Contact us to talk about your pension

Whether retirement is just around the corner or years away, we could help you create a retirement plan that suits your lifestyle and goals. Knowing that your pension has been reviewed by a professional and having someone you can discuss your retirement with could boost your confidence in your long-term plan.

Please contact us to speak to one of our team and arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.