The start of a new year is the perfect time to get your finances in order.

A few simple changes could improve your finances in 2021 and beyond, setting you up for a healthier financial future.

So, whether your finances are in a muddle or you just want to ‘do better’, here are five new year’s resolutions worth sticking to.

1. Create a spending budget

If your bank balance has been getting worryingly low, it’s probably time to take a thorough look at your spending habits.

Creating a budget is a useful exercise whatever stage you’re at in life. And you may be surprised at how easily you’re able to save extra money each month.

The following simple steps can help you create a successful budget:

- Work out how much money you take home each month

- Add up your monthly outgoings

- Calculate the difference

If your expenses are greater than your income, check if there’s anything you could cut back on. We’re not suggesting you scrap all of your little luxuries. However, there may be lots of things you’re spending money on that you don’t actually need, such as unused magazine subscriptions or gym memberships.

If your income is higher than your outgoings, consider adopting the ’50-30-20’ budgeting philosophy. This is where essential expenses comprise half your budget, other expenses make up 30%, and the remaining 20% goes towards savings or paying off debt.

2. Pay off expensive debt

If you’ve racked up a lot of debt, the new year could be a great time to start tackling it.

The higher the interest rate, the more the debt will cost you, so it’s usually a good idea to pay off expensive debts first. These could include credit card and store card debts, unauthorised overdrafts, and payday loans.

Paying off your debts could enable you to save more money for your future, improve your credit score, and reduce any anxieties you’re feeling about your finances.

Some loans come with high early repayment penalties, so make sure you read the terms and conditions before paying them off.

3. Increase your pension contributions

If you’ve got extra money sitting around or recently received a pay rise, it could be worth increasing your pension contributions.

Each time you pay into a pension the government tops it up with 20% tax relief, making it a great way to save for your future.

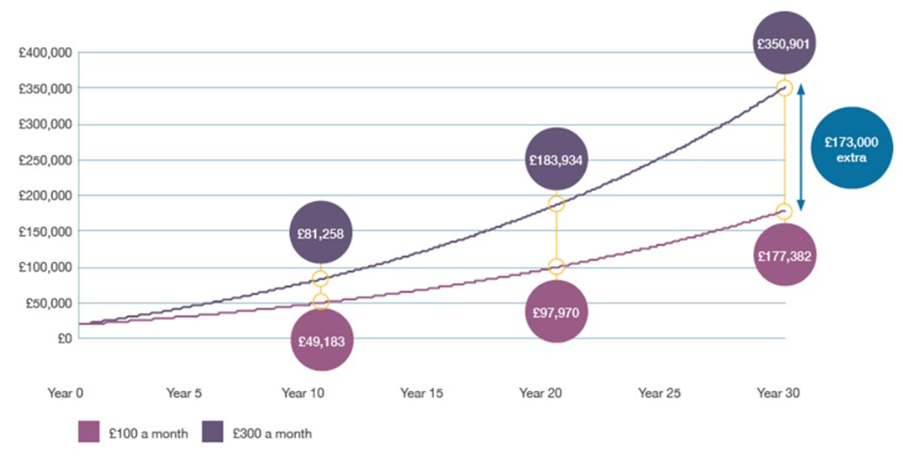

The chart below shows how quickly monthly pension contributions can add up over time. It shows two £20,000 pensions growing by 5% a year over 30 years. One has £100 paid into it each month, and the other has £300.

Source: Bestinvest

It’s never too late to start preparing for your future. However, the earlier you start investing, the better your chances are of living the retirement you desire.

Research by Which? suggests couples need £27,000 a year to live a comfortable retirement, or £42,000 a year to live a luxury retirement that includes a holiday every year and a new car every five years.

Couples would need a pension pot of around £215,450 to produce enough income for a comfortable retirement via income drawdown, or £298,000 through a joint-life annuity. For a luxury retirement, these figures rise to £502,775 and £695,000, respectively.

4. Invest in a Stocks and Shares ISA

Investing in a Stocks and Shares ISA has several benefits. Your money grows free of Income Tax and Capital Gains Tax, and you can withdraw money whenever you like without paying tax.

This makes ISAs a useful vehicle for holding money that you might need to withdraw before retirement. Money inside a pension can’t be accessed until you’re at least 55-years-old, rising to 57 in 2028.

Additionally, because ISA withdrawals are tax-free, they can be a tax-efficient way of taking income in retirement. With a pension, you can withdraw up to 25% tax-free and the rest is taxed at your marginal Income Tax rate.

You can pay up to £20,000 into ISAs in the 2020/21 tax year. Keep in mind that when investing, your capital is at risk. You should invest with a minimum five-year timeframe in mind.

5. Make a will

Making a will is an essential financial exercise, yet research by Royal London suggests 57% of UK adults don’t have a will in place.

If you die without a will, it could cause immense stress and financial hardship for your family. In a worst-case scenario, your loved ones could inherit nothing and become embroiled in bitter disputes.

By making a will, you can ensure:

- Your money and assets end up in the right hands

- Your children are cared for by people you know and trust

- Your unmarried partner and stepchildren are provided for

- Your family can continue living in their home

- Your estate doesn’t attract unnecessary Inheritance Tax

Writing a will can give you the peace of mind that your loved ones will be protected long after you’ve gone.

Get in touch

If you want advice on getting your finances in order, we can help. From helping you create a financial plan to organising your pensions and other assets, we’ll ensure your new year is off to a flying start. Please contact us to arrange a meeting.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change in the future.

The Financial Conduct Authority does not regulate will writing or estate and tax planning.